Despite insurance being a giant industry in the Philippines, life insurance penetration remains low. Additionally, much this sector remains technologically underdeveloped. To see if they could disrupt this industry, the venture studio I was working in decided to build InsurePlus: a membership program that provides access to the top life insurance providers in the Philippines.

Problem

Choosing the best insurance provider is a challenging process.

In the eyes of the Filipino layman, insurance providers are difficult to differentiate from. Their proposals aren’t user-friendly at all, filled with verbose paragraphs and dense tables.

Solution

What I proposed: personally tailored proposal comparisons

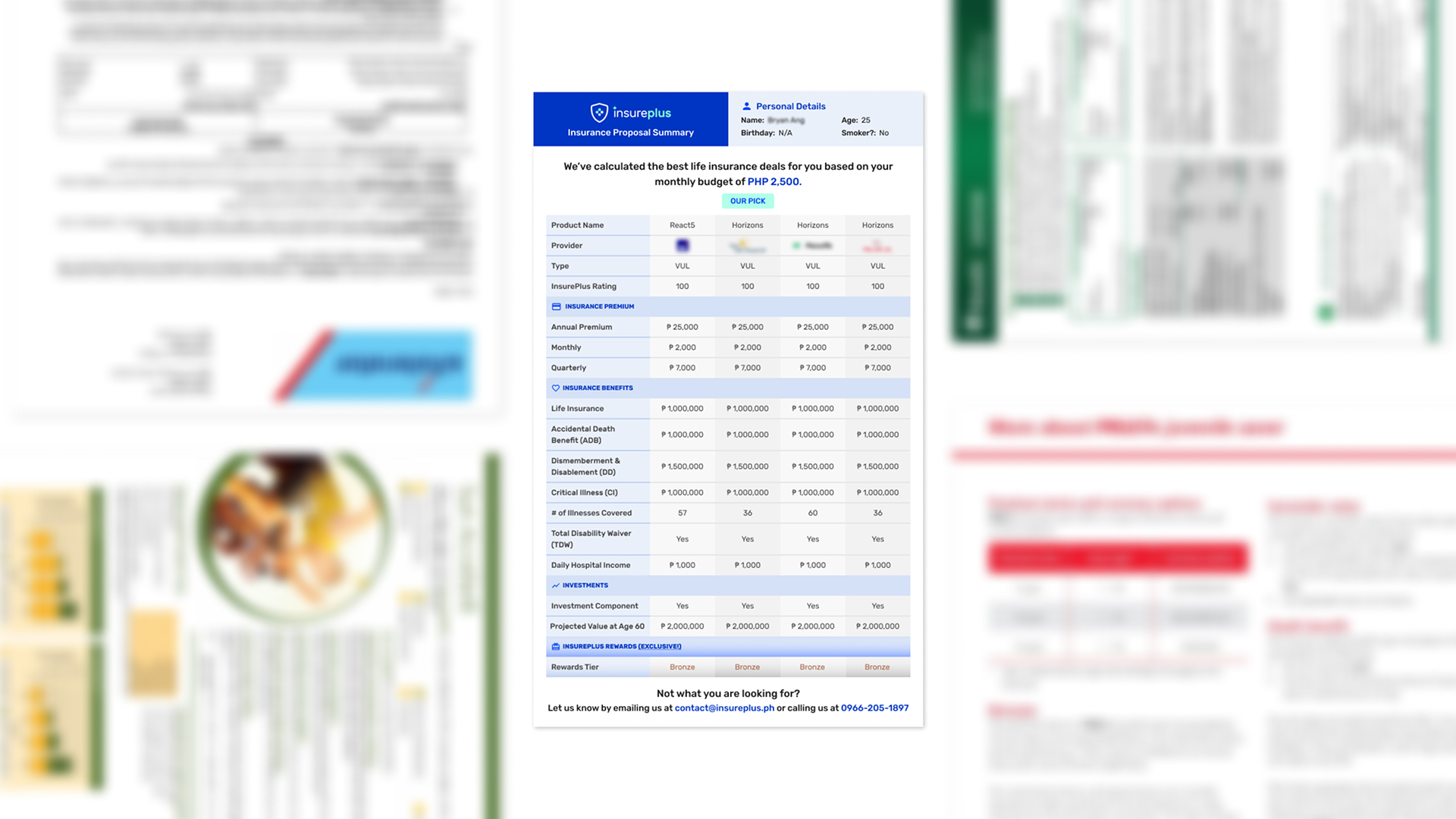

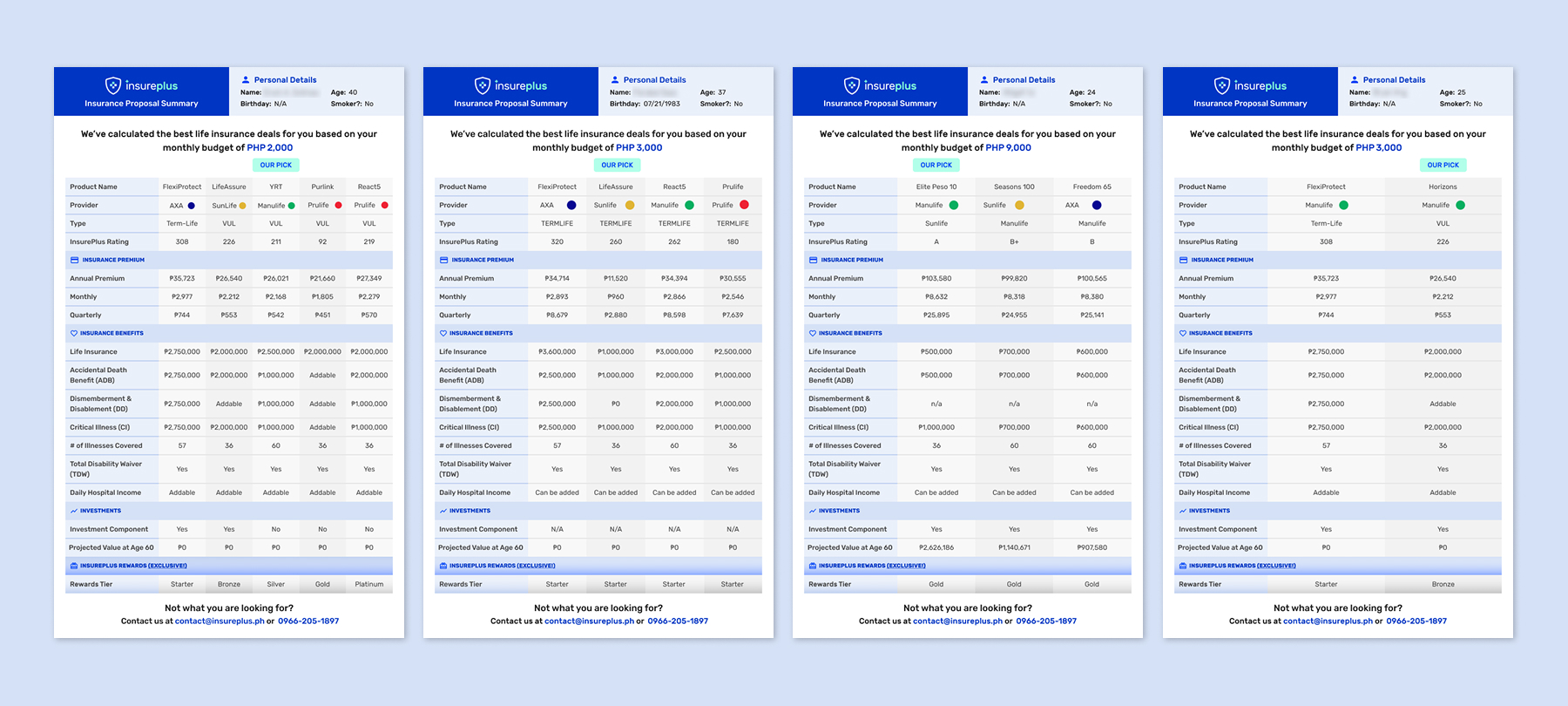

I created a proposal summary template consisting of the following:

- The customer's monthly budget (the basis of the proposal)

- A comparison matrix (i.e. product details, insurance premium, insurance benefits, investments)

The proposal summary changes depending on the number of proposals that are fit for the customer.

Note: Had to change from logos to colors in order to avoid getting in trouble with the involved companies

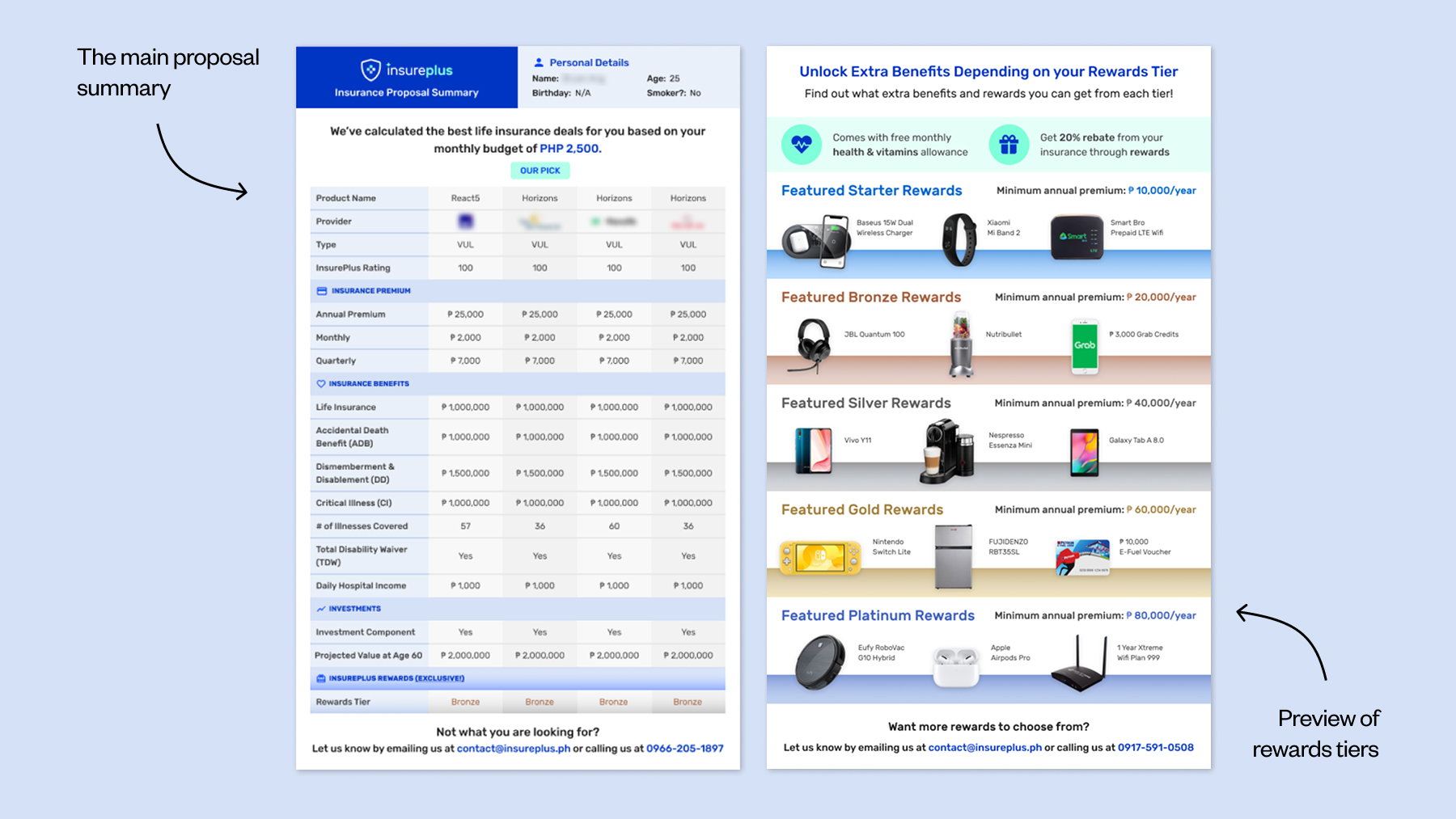

Accompanying the main proposal summary is a preview of the rewards tiers they could avail through the InsurePlus program.

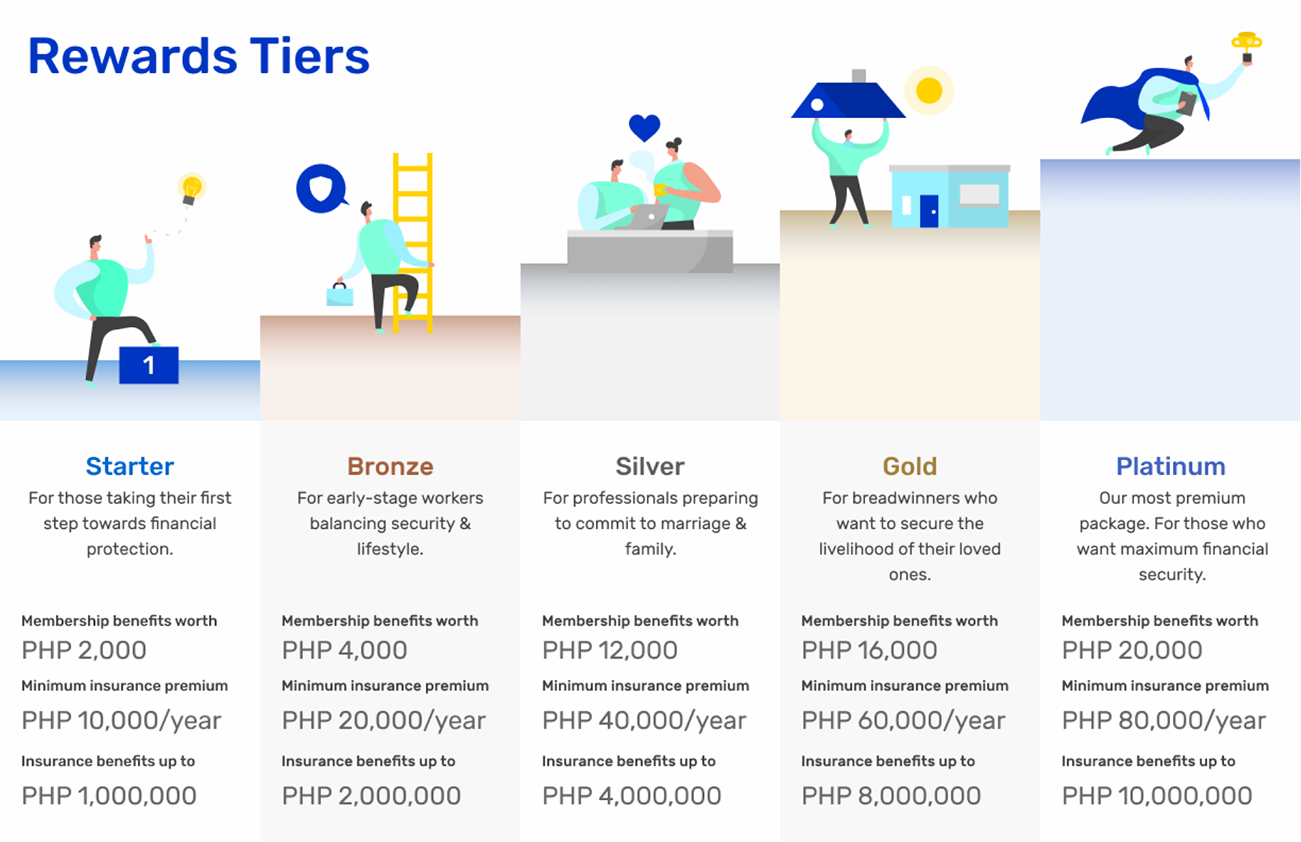

Durng the earlier stages of InsurePlus, its value proposition was more focused on rewards.

Left: overview of rewards tiers; right: individual pages for each rewards tier

However, this had to be changed because of the following reasons:

- Marketing focused on rewards attracted low-quality leads (i.e. only looking for freebies, no interest in insurance)

- InsurePlus could have been accused of inducement

- UX research showed that customers cared more about the insurance itself

Proposal Generation Workflow

How could the team keep up with the demand?

When we started sending these summaries out, response rates to our e-mails skyrocketed. However, this came at a cost; so many leads were asking for summaries, and the team struggle to deliver since they were still making these summaries manually.

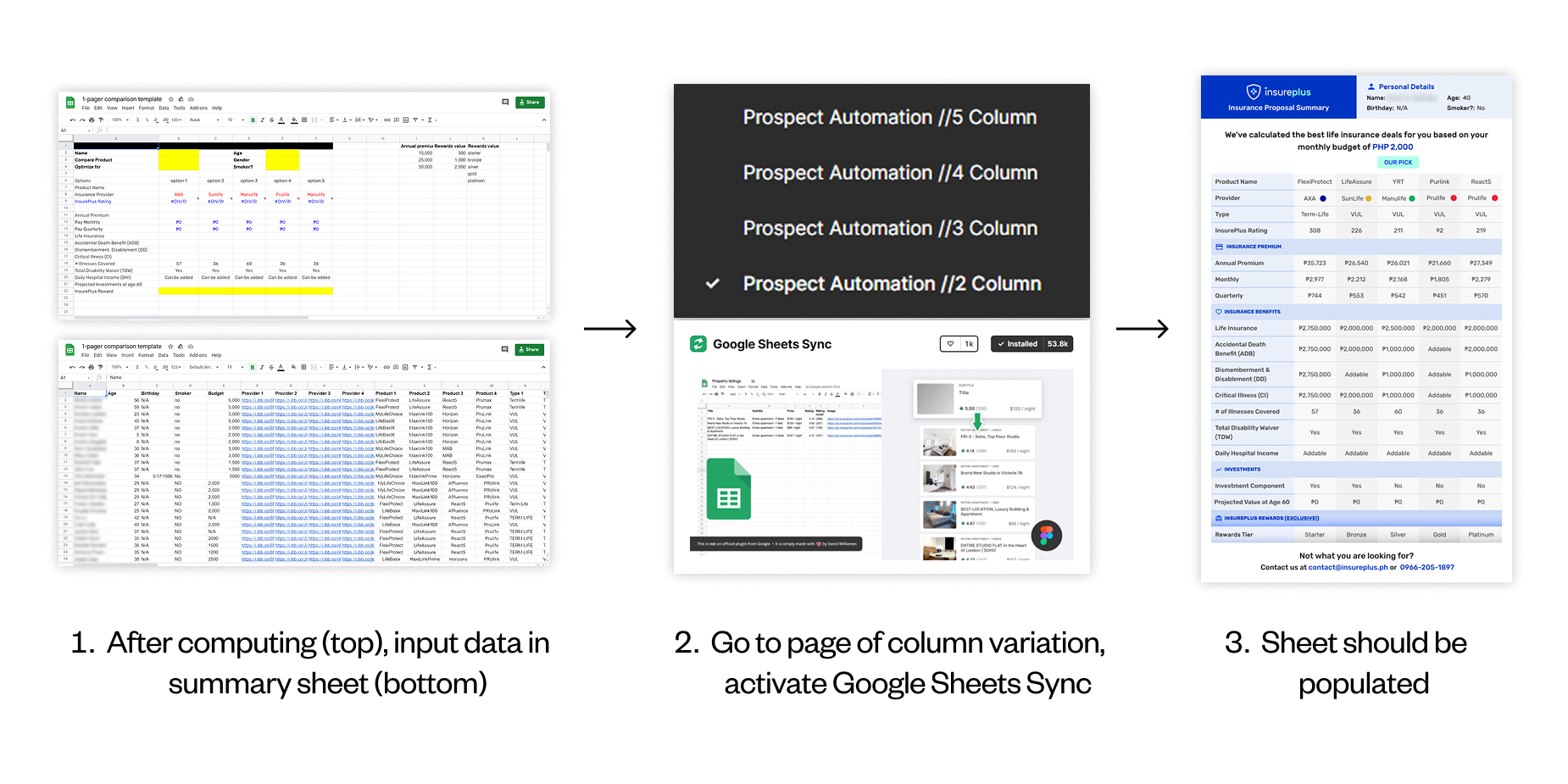

To make operations easier, I configured the proposal templates to sync with Google Sheets. Here's how the templates would be generated:

- Insurance agent computes for values based on chosen proposals (e.g. monthly/quarterly payments, personal rating), then adds a row with all the data in a separate sheet.

- Insurance agent goes to the Figma file with the insurance templates, then duplicates a new one.

- Insurance agent activates the Google Sheets Sync plugin.

- The duplicated template is populated with new data.

With this, the team no longer had to copy paste data from sheets into the templates, since the whole process was automated for them.

Proposed Improvements

How could proposal generation be further optimized?

While this template + workflow helped us moved faster back then (in 2020), it still wasn't the most optimized. This is because a lot still had to done manually, from selecting InsurePlus' "Our Pick" to exporting the entire template.

Because of this, it required being able to use Figma. While I recorded a Loom tutorial to guide the other team members through the process, this didn't make it fully accessible. What if there were other agents who had less technical savvy? Thus, this process would not be scalable over time.

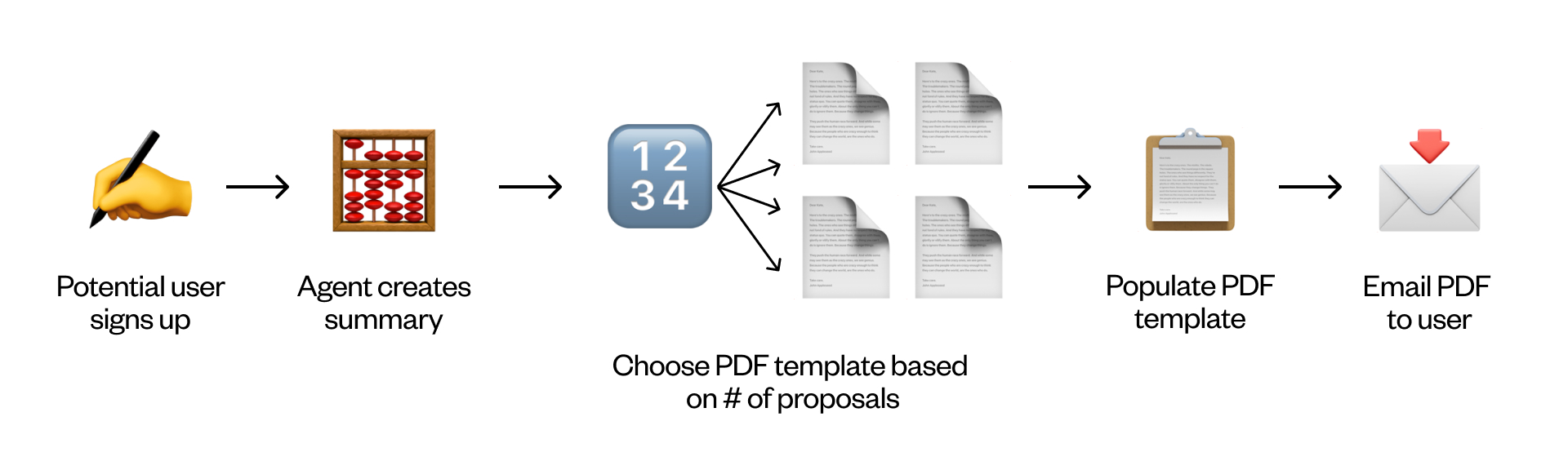

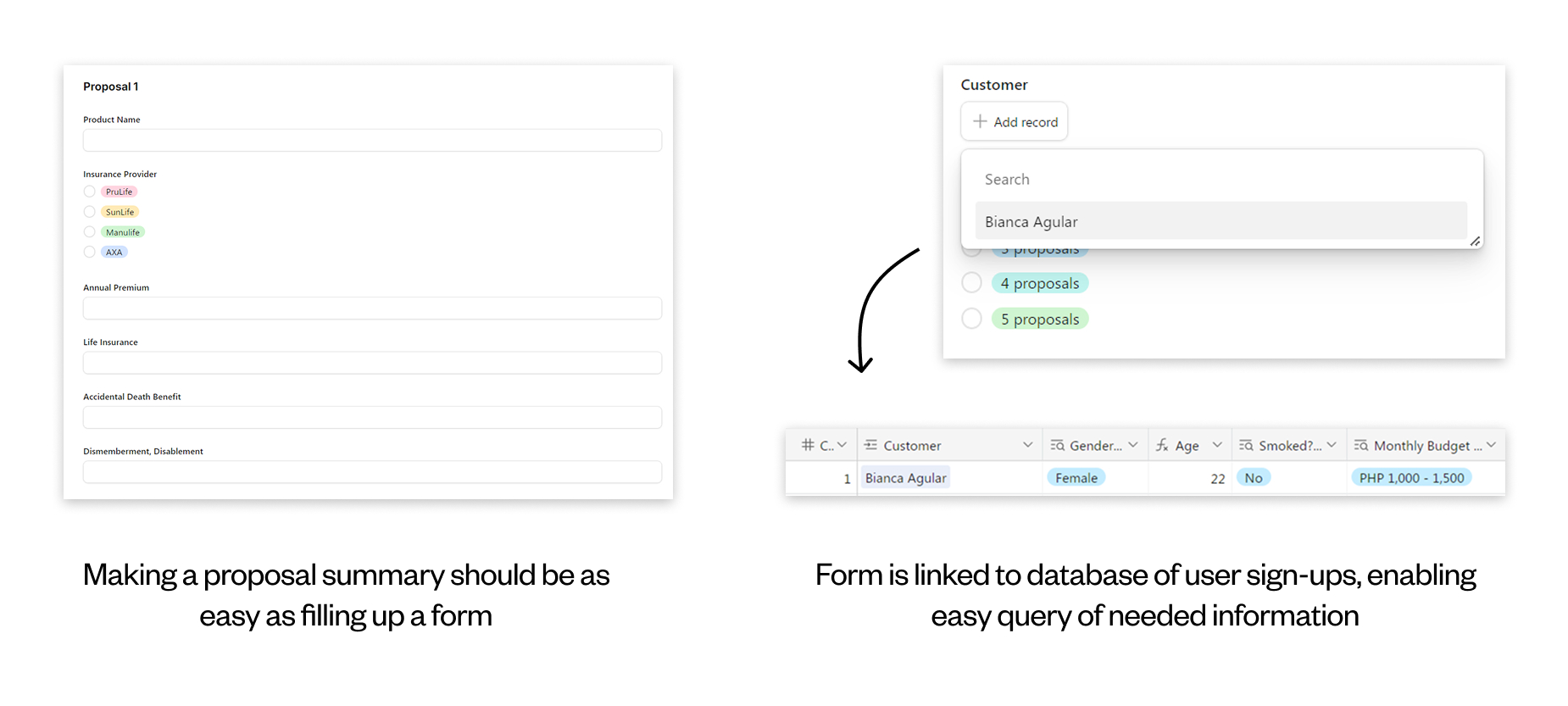

What I'd do today is remake the entire workflow with automation. This could be done with no-code software like Airtable and Make, but it could also be fully developed.

All the agent would have to do is fill out a form, making the UX for inputting data much easier.

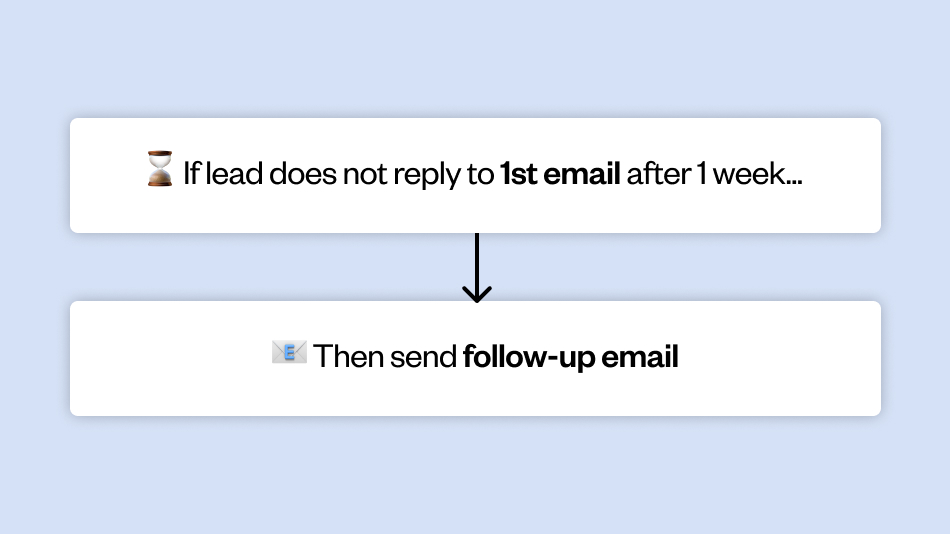

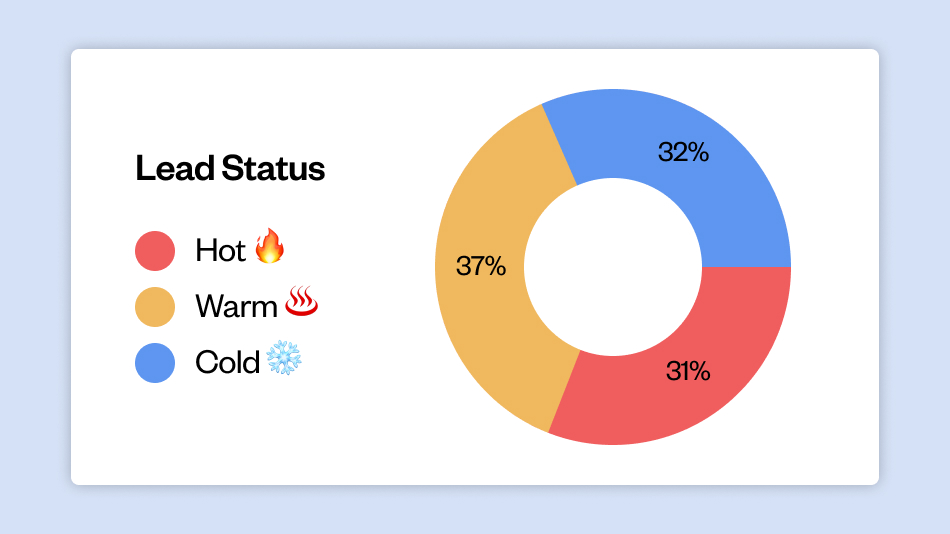

If automation can free insurance agents from manually reaching out to their leads, it should also be able to help with tracking leads and following up on them. AI could be used to help categorize leads by warmth. Then, following up on them could be automated depending on this status.

Diagram of follow-up automation

Pie chart based on lead status